is there real estate tax in florida

Florida Property Tax Rates. Property taxes apply to both homes and businesses.

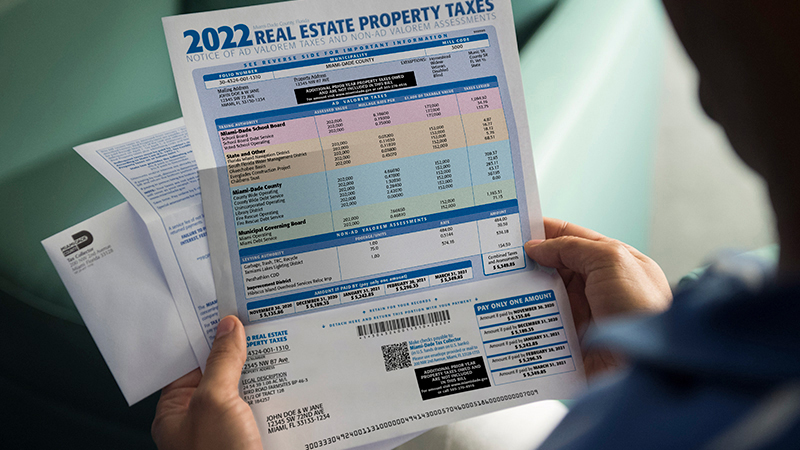

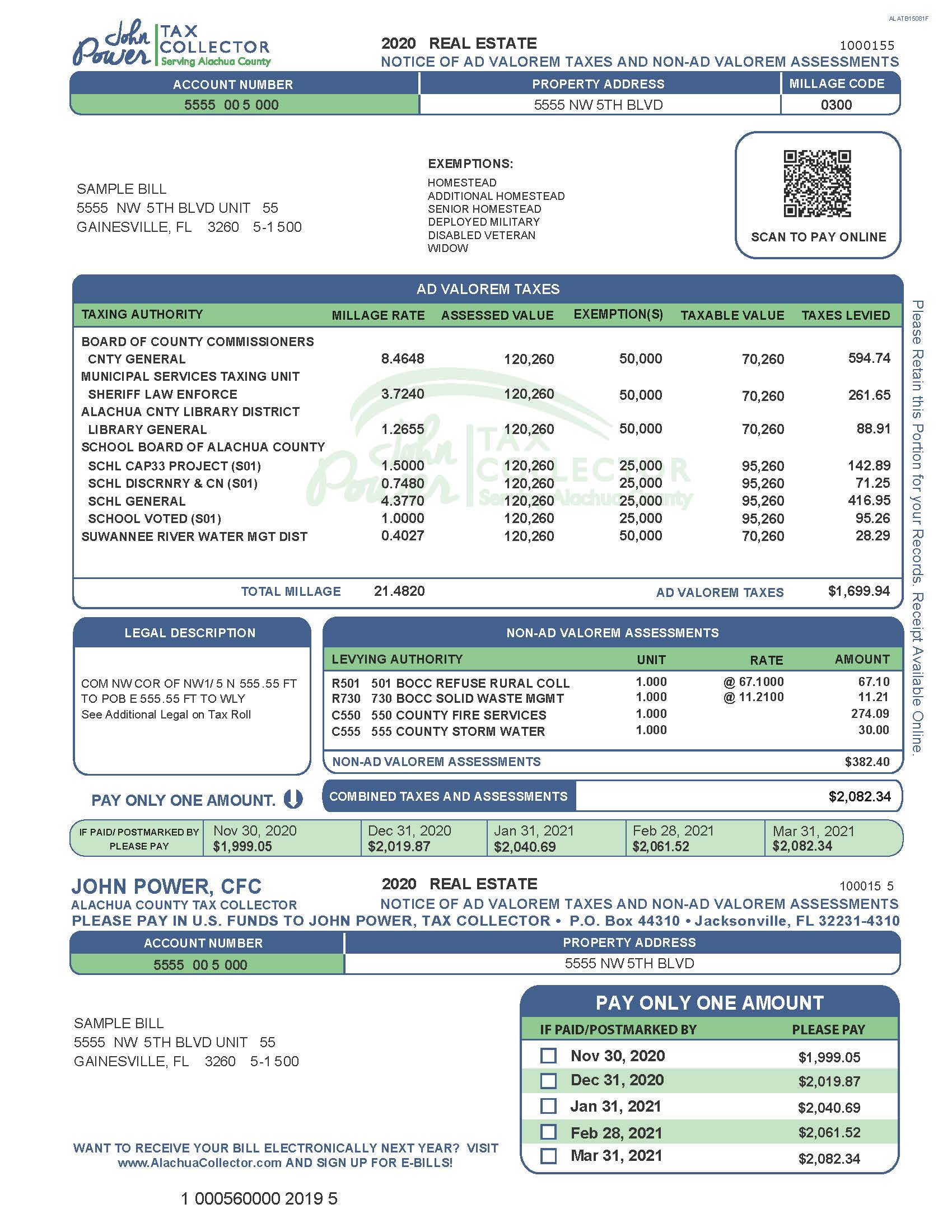

A Guide To Your Property Tax Bill Alachua County Tax Collector

Since floridas estate tax was based solely on the federal credit estate tax was no longer due on estates of decedents that died on or after january 1 2005.

. Florida does not have an inheritance tax so Floridas inheritance tax rate is. There is no state income estate or gift tax in Florida. Since floridas estate tax was based solely on the federal credit estate tax was no longer due on estates of decedents that died on or after january 1 2005.

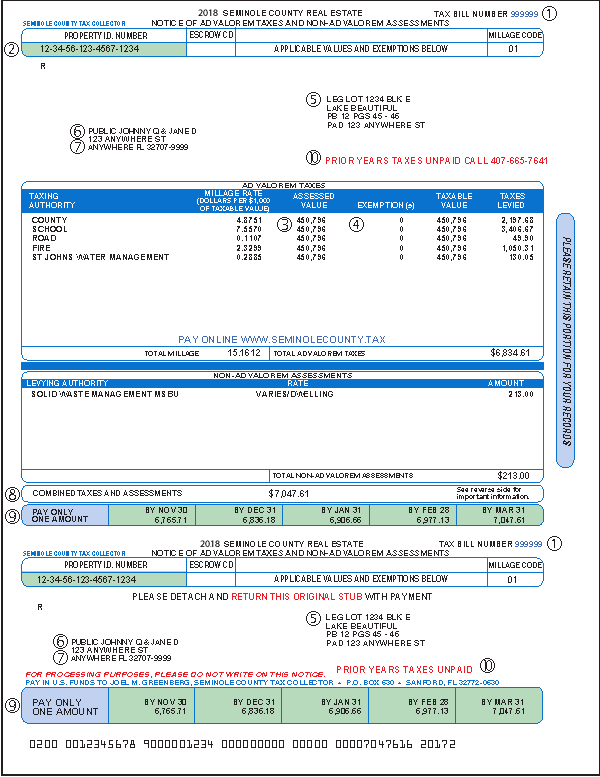

First all properties in Florida are assessed a taxable value and. Your Income And Filing Status Make Your Capital Gains Tax Rate On Real Estate 15. Owners pay the tax to their local municipality which is also the entity responsible for setting the tax rate.

As a result of recent tax law changes only those who die in 2019 with. Does Florida Have Capital Gains Tax. The Portability Amendment literally made that tax savings portable so you can now transfer up to 500000 of your accrued Save Our Homes benefit to your new home.

Property taxes in Florida are implemented in millage rates. Florida is ranked 18th of the 50. You should also be aware of federal estate taxes or estate taxes charged.

Is Florida The Right Place To Invest In Real Estate. There are also special tax districts such as. Special real estate exemptions for capital gains.

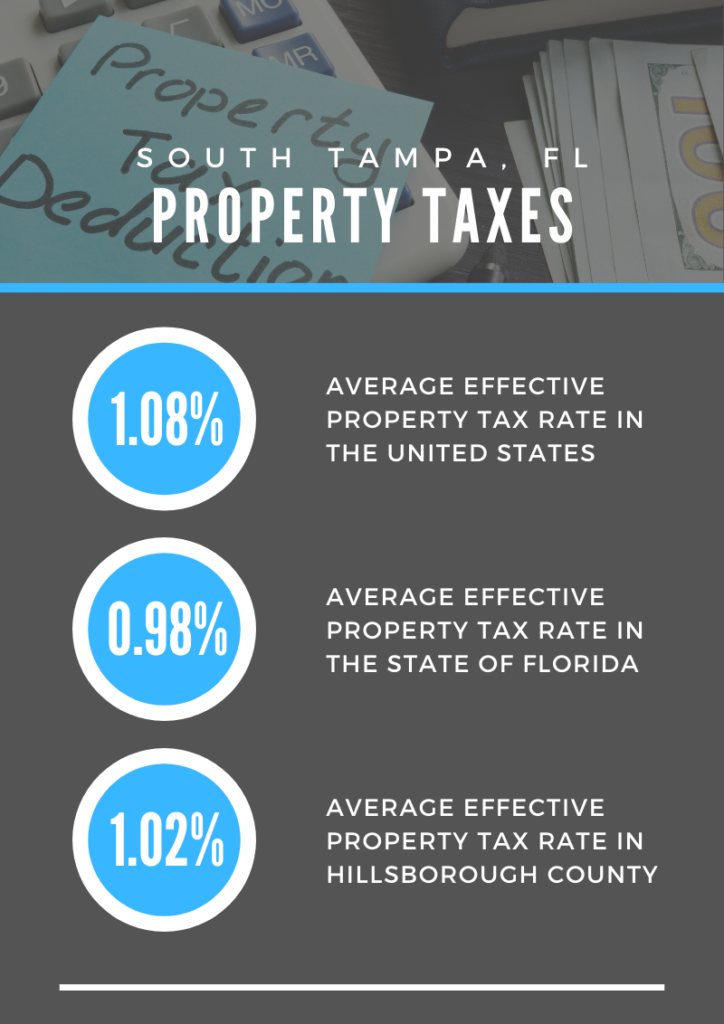

It is worth noting that there is no state property tax in Florida. The average property tax rate in Florida is 083. No there is no Florida capital gains tax.

Property taxes in Floridaare right in the middle of the pack nationwide with an. This equates to 1 in taxes for every 1000 in home value. The state sales tax is 6 but taking into account local sales taxes that rate can reach up to 85.

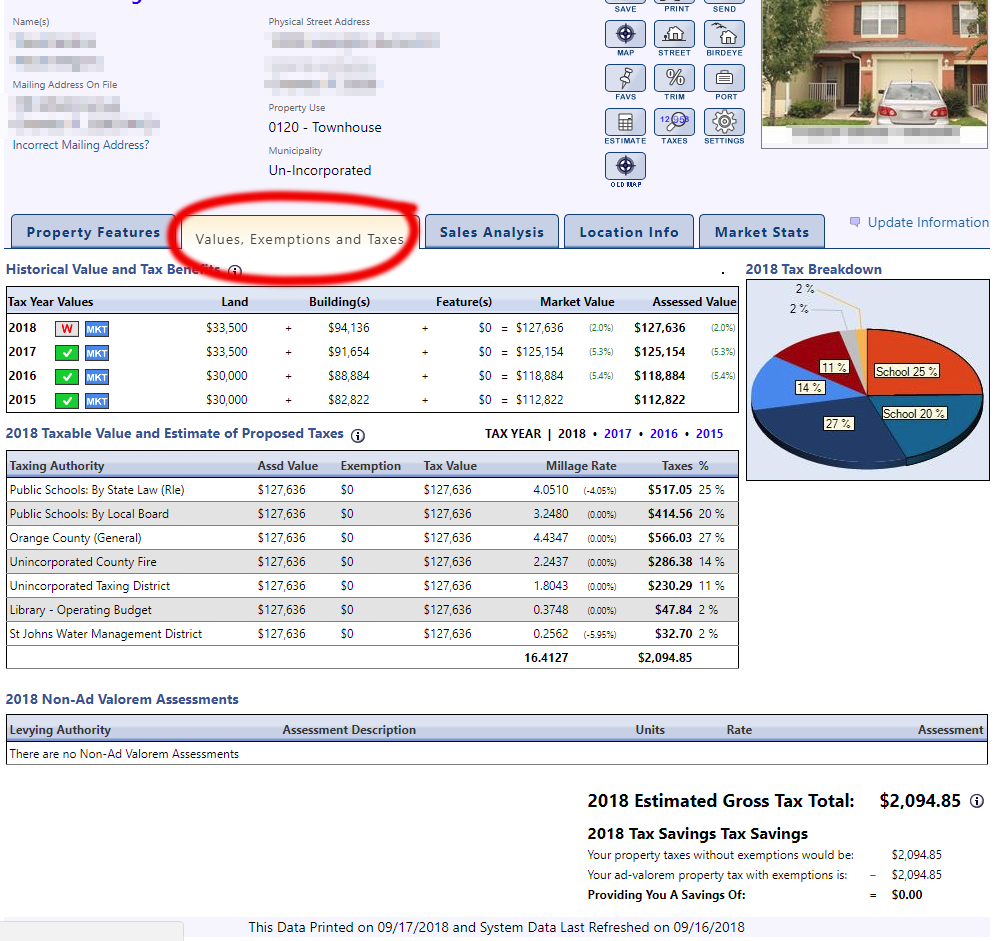

In Florida real estate transfer taxes also known as a stamp tax or doc stamp are imposed on the transfer of any residential and commercial property and any written obligation to repay the. Because of its favorable tax laws Florida is a good place to invest in real estate. The Florida real estate homestead tax exemption is by far the most popular and common way to reduce your property tax bill.

Meet Florida real estate agents near you and save thousands. If you own a house in Florida as your permanent residence you may be entitled to a. There are several reasons why people.

An inheritance tax also called an estate tax is a tax based on the wealth of a deceased person. Search Any Address 2. Floridas median income is 53595 per year so the median yearly property tax paid by Florida residents amounts to approximately of their yearly income.

Each county sets its own tax rate. Florida Homestead Property Tax Exemption. Guide to Florida Real Estate Taxes.

Florida real property tax rates are implemented in millage rates which is 110 of a percent. Florida residents no longer have to pay a Florida estate tax but there are forms you may need to fill out. Since Floridas estate tax was based solely on the federal credit estate tax was no longer due on estates of decedents that died on or after January 1 2005.

Download Property Records from the Florida Assessors Office. A millage rate is one tenth of a percent which equates to 1 in taxes for every 1000 in home value. But if you live in Florida youll be.

If youre putting together your Florida estate plan its wise to consider whether youll need to pay a federal estate tax. There is no gift tax in Florida. Here are the median property tax.

Quick SummaryThere is no inheritance tax or estate tax in FloridaThe estate of a deceased person in Florida could still owe federal inheritance taxes if the value of estate is over the. When youre thinking about selling real estate.

Property Taxes By State How High Are Property Taxes In Your State

Property Taxes In South Tampa Fl Your South Tampa Home

Florida Property Taxes Mls Campus

Tax Benefits Of Investing In Florida Real Estate Florida Property Management Sales

10 Highest And Lowest Florida County Property Taxes Florida For Boomers

How To File For The Homestead Tax Exemption Property Tax Tallahassee

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

Fl Florida 405 Tangible Personal Property Tax

Does Florida Have An Inheritance Tax Alper Law

Florida Real Estate Taxes What You Need To Know

Are There Any States With No Property Tax In 2022 Free Investor Guide

Florida Estate Tax Everything You Need To Know Smartasset

Cle Practical Tax Strategies For Real Estate Deal Structuring And Implementation Tax Section Of The Florida Bar

What Is Florida County Tangible Personal Property Tax

Tax Implications Of Canadian Investment In A Florida Rental Property

Estimating Florida Property Taxes For Canadians Bluehome Property Management